Depending on how deep your understanding goes in crypto, staking may be a complicated concept or a simple one. The fact that staking can be a way of earning rewards for holding cryptocurrencies is a big incentive for many traders and investors.

But even if you simply want to earn a little staking reward, it’s worth understanding at least the basics of how and why the system works.

Crypto staking is a method used to validate proof-of-stake blockchain transactions in return for rewards. Unlike mining, it involves locking coins in a crypto wallet, using less computational resource and yielding more predictable percentage returns.

In this tutorial, we cover the definition of crypto staking, plus a step-by-step guide of how to stake and manage your crypto coins.

What Is Crypto Staking?

Crypto staking is a system used to validate proof-of-stake (PoS) blockchain transactions, as opposed to proof-of-work (PoW) transactions which are done through mining. The difference between PoS and PoW is key to understanding the basics of how crypto staking works.

Proof-Of-Work Vs Proof-Of-Stake

PoW blockchains such as Bitcoin and Bitcoin Gold require each block to be independently verified. This is carried out by miners, who use computational power to solve complex algorithms in return for blockchain rewards. While all miners aim to discover the solution to the algorithm, only the first miner to solve it will receive the prize.

PoS was developed in response to the high computational resource and element of luck associated with PoW. With PoS, the likelihood of a staker creating the next block is dependent on how much they have staked – or how many coins they have stored for the blockchain they are verifying.

Coins are locked up in a crypto wallet when staking, meaning they can’t trade them in the usual way during this period. However, stakers can grow their wallet value over time, by receiving a percentage return for their staking efforts. BitGreen is an example of a proof-of-work blockchain, specifically launched as an energy-efficient alternative to Bitcoin.

How To Earn From Crypto Staking

For some people, crypto staking acts as a form of passive income and is similar to earning interest when holding money in a bank account. Several websites provide data that allow stakers to compare the highest staking rates. Online staking calculators can also be used to predict compound interest using the staking period and reward rates – also known as annual percentage yield (APY).

Crypto Staking Vs Liquidity Mining

Crypto staking differs from liquidity mining (also known as yield farming), which is the concept of providing liquidity to decentralised exchanges by depositing coins. This allows the coins to be used, exchanged or lent by other people in the exchange pool. It is not as secure as crypto staking, as it is more exposed to smart contract failures and can lead to impermanent loss. This is when the asset price changes once deposited, which can result in a permanent loss once the coins are withdrawn. However, crypto staking comes with higher initial investment requirements.

How Crypto Staking Works

Now we’ve covered crypto staking 101, let’s look in more detail at how crypto staking works.

When crypto staking, the chance of verifying the next block is proportional to the number of coins being staked. This means that a staker with one coin locked in their wallet has a 10% chance of verifying the next block if there are 10 of the same altcoin type in circulation. For this reason, the returns are a percentage of the coins being staked. However, the minimum staking requirements can be extremely high for some altcoins, making it inaccessible for most people. Staking pools are a good solution to this.

Staking Pools

Staking pools are a way for stakers to combine their stakes and split the rewards, allowing participation even if the minimum deposit requirements can’t be met. The blockchain is locked in a central wallet and is usually managed by a pool manager, meaning individuals don’t need to worry about managing their own crypto wallet. However, there can be fees associated with pools which means the overall profits are lower.

Countries & Taxation

Crypto staking is legal in lots of countries although it is usually subject to taxation. For example, in the UK, the HMRC specifically references that income from crypto staking is taxable as miscellaneous income for individuals. Similarly, in the US and Australia, the IRS and ATO state that income from cryptos is treated as normal income. The rules vary in Singapore however, which isn’t subject to capital gains tax on long term investments. Crypto staking taxation can differ for businesses, so make sure to check specific regulations.

Ethereum 2.0

Currently, one of the most high profile staking cryptos is ETH 2.0. Ethereum 2.0 is a series of updates to the Ethereum network that as well as improving the network’s scalability, will also involve switching from the current PoW model to a staking model.

So when is Ethereum 2.0 happening? The first Ethereum upgrade took place in 2020, with the second planned for 2021. Ethereum has been reluctant to confirm a final launch date, though news rumours suggest it will be around 2022. The Ethereum launchpad is designed to walk crypto stakers through the process, which will involve joining the validator queue, running a staking node and depositing a minimum stake of 32ETH (individually or part of a staking pool), in return for up to 6.0% APR. A specialised machine isn’t required for staking Ethereum 2.0, making it an accessible investment opportunity for all.

Crypto Staking Risks & Rewards

Rewards

In this section we capture the benefits of crypto staking:

- Returns – Even though staking returns can be both fixed and variable, they are more predictable than PoW crypto mining. As decentralised currency rates aren’t correlated with monetary policy, staking yields can remain high even when interest rates are dropped.

- Resource – The proof-of-stake model doesn’t require high computational resources unlike the proof-of-work verification method, making it more energy-efficient and accessible to people with less computer power.

Risks

There are also disadvantages that crypto stakers should be aware of:

- Market volatility – The difference between staking vs holding is that coins are locked in when staking, which can make it a far riskier strategy. Cryptos are famous for their price volatility, so while the staking rewards may seem lucrative, they can quickly become irrelevant if the crypto price soars or plunges.

- Minimum stakes – The minimum deposit requirements for staking can be unaffordable for the average person, though staking pools are a good solution to this.

- Lock-up period – Stakers will need to lock away their coins to benefit from staking. Lock-up periods can be months or even years, so ensure that you don’t require access to your assets in this time.

- Taxes – As staking rewards are treated as income, they are subject to income taxes in most countries.

How To Start Crypto Staking

If you’re wondering how to start staking crypto, look no further. Whether you want to lock in XRP, 1 INCH, CRO, USDT or Quant, we provide a step-by-step guide for crypto staking beginners.

Select A Coin

First, select the altcoin you want to stake. Consider the minimum staking requirements, potential yield, lock-up time and reward payment frequency. There are several great comparison websites that provide crypto staking lists, ranking coins based on these factors. Researching the altcoin news is also recommended, to ensure you won’t be locking away a coin that will immediately lose its value. Check the crypto value and use a tracker to see historic price information.

Manage Your Coins

Next, you’ll need somewhere to manage your cryptos for staking. This can be done via a crypto exchange service, a crypto wallet provider or a platform that provides Staking-as-a-Service.

Staking-as-a-Service (also known as DeFi, or Decentralised Finance staking) are platforms set up for crypto staking only, aiming to remove the hassle from staking in return for a fee. This differs from crypto wallets and exchange services which offer other services too.

Crypto Exchanges

Here we list some of the most popular crypto staking exchanges and their offerings:

- Kraken – By permitting off-chain staking it’s possible to carry out Bitcoin staking on Kraken, even though it is a proof-of-work blockchain. Customers can also stake Ethereum for rewards on Kraken as explained on their website, which has a useful guide for staking ETH2.0, plus FAQs.

- Binance – A great range of over 30 cryptocurrencies are available for staking on Binance. Binance also offers DeFi staking, which allows users to easily participate in staking without needing to manage private keys or make trades.

- eToro – Cardano staking is hassle-free and transparent on eToro, with an automated staking procedure that delivers monthly rewards.

- Gemini – As well as providing crypto staking services (including Ethereum 2.0), Gemini offers a host of educational resources about crypto staking.

- Coinbase – Ethereum 2 crypto staking is possible on Coinbase for US customers, excluding New York residents.

Crypto Wallets

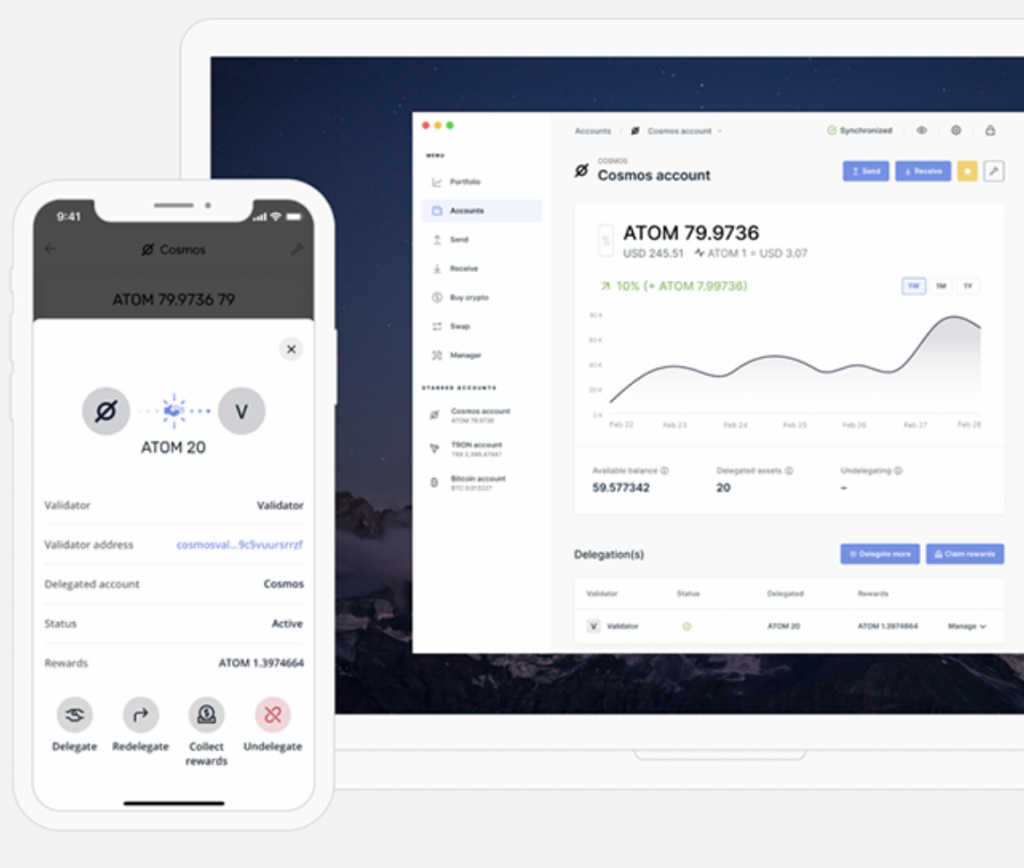

Crypto wallets are another medium that can be used for crypto staking and are either ‘hot’ (connected to the internet), or ‘cold’ (completely offline). Ledger is an example of a cold hardware wallet that permits crypto staking and has pledged to be Ethereum 2.0 compatible. Being offline means it is less susceptible to hacking. However, the coins have to be kept at the same address throughout the lock-up period to earn the rewards. Alternatively, Exodus is one of the best crypto staking hot wallets, which allows customers to manage their staking from the mobile app. Uphold is a unique example of another crypto wallet that allows customers to stake Cardano (ADA), without needing to lock up their funds for a set period of time.

Staking-As-A-Service (DeFi Staking)

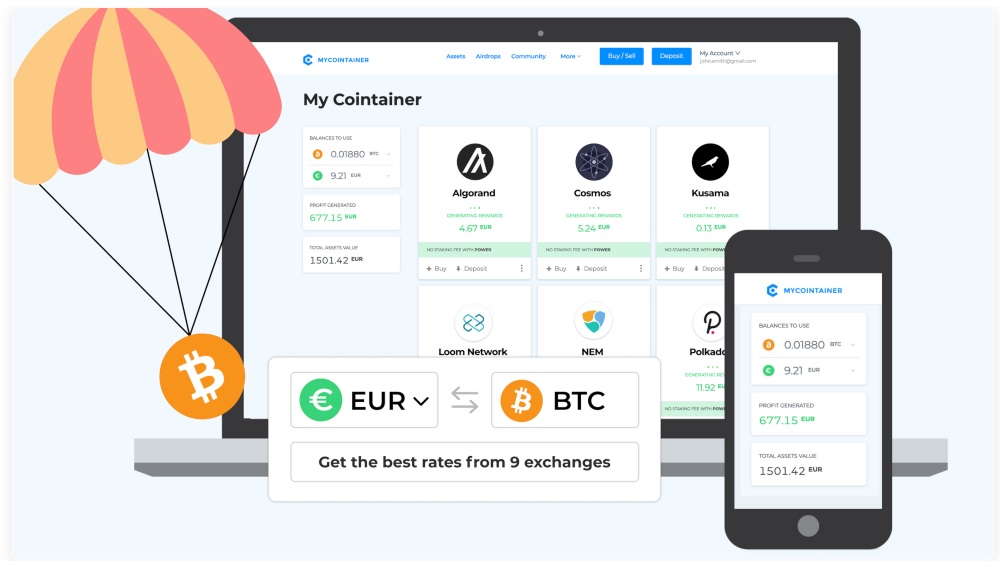

MyCointainer is an example of a Staking-as-a-Service platform and app designed to remove the complexity of crypto staking projects. However, some people believe that DeFi staking is actually a Ponzi scheme, as the providers are only acting as middlemen and not taking on any risk.

Develop A Strategy

Once set up, having a plan is key. Develop a crypto staking strategy that defines how much you want to stake and for how long. Are you looking for fixed or variable returns? There are numerous crypto staking options, all of which depend on how much risk you’re willing to take.

It’s even possible to carry out automated crypto staking by programming a Raspberry Pi computer (for example by running an Ethereum node), creating a Docker app or a Discord bot. YouTube is a great place to learn how to develop these applications.

Closing Thoughts On Crypto Staking

Crypto staking is an energy-efficient alternative to the mining system used for proof-of-work blockchain verification. As well as this, it provides stakers with opportunities to earn more predictable rewards that are proportional to the number of coins staked, rather than attempting to be the ‘lucky’ first miner to solve the algorithm.

While it can seem like an easy way to generate a passive income using your crypto holdings, it’s important to remember that staking requires cryptos to be locked up. This can make crypto staking a very risky strategy, as it means the owner has no power to trade, even if the asset price soars or drops.

FAQ

What Is Crypto Staking?

Crypto staking is a method used to validate proof-of-stake cryptos such as ETH2.0, equivalent to mining that is used for proof-of-work blockchain validation. Stakers are rewarded for the validation with a percentage yield return.

Is Crypto Staking Taxable?

Crypto staking returns are taxable in lots of countries including the UK, US, Canada and Australia. However, Singapore-based investors aren’t subject to capital gains tax on long term investments.

Is Crypto Staking Worth It?

Crypto staking is a method that can provide good annual percentage yields, by simply holding coins in a wallet. However, it requires stakers to lock up their crypto, meaning if the asset price drops, it could result in losses overall. As with all crypto investments, staking should not be considered safe.

What Is A Crypto Staking Pool?

A crypto staking pool is a way for individuals to group together and form a larger stake, sharing any returns. This makes it easier to meet the minimum deposit requirements for staking.