Bitcoin is the oldest cryptocurrency and has the largest market share out of any cryptocurrency in the market. This is why it holds so much sway when it comes to the global cryptocurrency market. Even though other cryptocurrencies have better consensus mechanisms and better transaction times, Bitcoin is central to the cryptocurrency market.

This centrality is the reason that Bitcoin’s rise and fall is congruent with the rise and fall of the crypto market. However, it’s not the only reason. Here are 5 reasons why Bitcoin is the central cryptocurrency in the market.

Bitcoin Is the Original Cryptocurrency

Bitcoin is over 10 years old and the first cryptocurrency. It was first created in 2009 and since then it has grown to become the most financially viable and popular cryptocurrency. It introduced Blockchain as a universal data transfer system without boundaries or borders, and the first digital currency. This alone deems it extremely valuable for generations to come.

However, Bitcoin’s popularity has grown and it’s now seen as a great tool to hedge against inflation. Not only that, but Bitcoin is the most accepted cryptocurrency in the world. At the moment, there are several businesses including some Subway restaurants which accept Bitcoin payments. You can’t say that about other cryptocurrencies.

Bitcoin Dominates the Crypto Market

Did you know that Bitcoin has an over 40% market share in the cryptocurrency market? This is one of the main reasons that Bitcoin is central to the cryptocurrency market. If Bitcoin falls, then most of the cryptocurrency market cap goes with it.

Just think of Bitcoin as being the foundation of the crypto market just as housing was for the American economy. In the 2008 economic recession, the housing market crash resulted in the crash of the century.

There have been similar booms and busts in the crypto market right when Bitcoin has surged and crashed. In 2017, when the first big boom happened, the cryptocurrency market surged to fourfold its value.

Right after that boom, a bust brought down the value of Bitcoin from over $20,000 to over $6,000. The next boom occurred during 2021, the second year of the COVID-19 pandemic. This time the cryptocurrency market surged to $2.5 tr. This was followed by another bust, another boom, and then the cycle repeated. At the time of publication, the value of the crypto market cap is $2 trillion. The value of Bitcoin hangs around $19,500.

If you look at the charts, there is an almost exact correlation between the Bitcoin and crypto market cap.

Bitcoin is Central to the Cryptocurrency Market as a Foundation

Bitcoin can be compared to the dollar in the way that it’s used as a benchmark for other cryptocurrencies. The dollar is used to buy oil and sets the value of several other assets by correlation. Similarly, Bitcoin is used to measure altcoin prices. Original crypto assets can be flanked by over 3000 competitors. However, Bitcoin commands over half the entire cryptocurrency market cap. This dominance of the market affords it a lot of control.

Also, several other altcoins can’t be purchased directly with fiat currencies. Hence, you have to buy Bitcoin to buy those coins. The majority of buyers purchase Bitcoin, and then use it to buy their altcoin of choice. Even if they decide to sell their altcoins, they will have to convert them back to Bitcoin first.

This presents the fundamental reason why Bitcoin is central to the crypto market. It’s the medium through which most transactions have to take place before conversion to ‘real money’. This means that without Bitcoin, several altcoins would be all but useless in the real world.

Hence, if Bitcoin goes down, altcoins go down. In fact, several altcoins drop even further than Bitcoin because their value depends on Bitcoin completely. Without it, their value would essentially be zero.

Another reason why Altcoins are so dependent on Bitcoin is that many are essentially Bitcoin clones. It’s become incredibly easy to replicate the Bitcoin structure and functionality today. That’s why Bitcoin is still very much the foundation of the crypto market.

Take Litecoin, which was the first altcoin to see mainstream acceptance. It is a copy of the Bitcoin code with the goal of becoming a lighter and faster version of the cryptocurrency. Several other clones like Bitcoin Cash and Bitcoin Diamond exist. There are dozens, if not hundreds more. Each one is dependent on the functionality that Bitcoin originally brought to the mainstream.

- Crypto Exchanges Store Bitcoin

There are about 2.6 million Bitcoin sitting in crypto exchanges at the moment. That’s not in terms of dollars, but actual units of Bitcoin in total. These reserves are necessary to shield exchanges from the sudden fluctuations in the crypto market as a whole. Since they depend on Bitcoin as a reliable medium of exchange, it’s no wonder the entire market does too.

Several cryptocurrency platforms don’t even have crypto to fiat trading due to compliance problems. Hence, the investors usually invest in Bitcoin first to trade for altcoins. Several pure crypto traders don’t even compare altcoin prices to fiat currencies. They only relate them to Bitcoin.

- At Times Altcoins Surge in Value While Bitcoin Drops

It’s a rare occurrence, but it’s been known to happen. The basic reason for it is investors at times pull money from Bitcoin and invest in altcoins. These altcoins may be showing promise including assets like Dogecoin or XRP. Conversely, if Bitcoin does well, investors pivot back and invest in Bitcoin.

This is a game that has been going on in the stock markets as well. It’s not out of the ordinary. However, these account for minor fluctuations. If a big rise or a big drop does occur, then the altcoins follow Bitcoin.

Bitcoin is Perceived as the Most Stable Cryptocurrency

While it is accepted that cryptocurrency is volatile, Bitcoin is seen as the most stable of cryptocurrencies. This is demonstrated by the fact that several investors have kept their money in Bitcoin for years and made profits.

Also Bitcoin has been seen as an effective hedge against inflation.

- Developing Countries See Bitcoin as a Stable Currency

Bitcoin’s relative strength against other tokens has to do with its political use as well. Countries like Venezuela and Brazil have repeatedly sought to invest in Bitcoin to preserve their currency’s value. Ongoing civil unrest and economic struggles in Turkey also resulted in a significant investment into Bitcoin. Certain reports have even suggested that large proportions of Turkish assets have gone into Bitcoin to counteract the Lira’s decline.

Other countries have gone a step further. El Salvador, for example, passed a law in 2021 to legalize Bitcoin as legal tender. This gave the currency equal footing in the country as the US dollar. Since the country’s GDP is heavily dependent on remittances, using Bitcoin was an obvious step to gain economic footing.

The Central African Republic has also approved Bitcoin as legal tender. The reason behind this is the country being rich in minerals and resources, but otherwise very poor. Wracked by conflict for decades, the country legalized the cryptocurrency to gain some footing in the economic race.

- Bitcoin Mining Still Thrives Even If Costs are Rising

The cost of mining Bitcoin has risen astronomically as the currency has thrived. However, the mining rigs functioning around the world are still being enhanced and run at full power. While they consume more power than a lot of nations on their own, the practice is deemed to be worth it.

There is a network of 18 million Bitcoin miners all around the world. This is the biggest network of miners for any cryptocurrency by far. The entire volume of participants represents the vast confidence that the community has for the crypto asset.

The reason is that Bitcoin often registers high gains and even when it crashes, it ends up gaining in the long term. This been seen repeatedly when the currency has boomed-and-busted. As a result, money being put in to mine a single Bitcoin is often seen as a good long term investment. In the long run, the effort put into mine the currency can be recovered during a boom.

Also, due to the commercial and widened use of Bitcoin, there is a lot of incentive to hold on. As wide as its use becomes, the less likely the currency is to crash. At the moment, the cost of mining a single Bitcoin is approximately $35,404. The value of Bitcoin currently sits below that, but its peak of over $68,000 is double that investment. This is why the frenzy to mine Bitcoin is worth it.

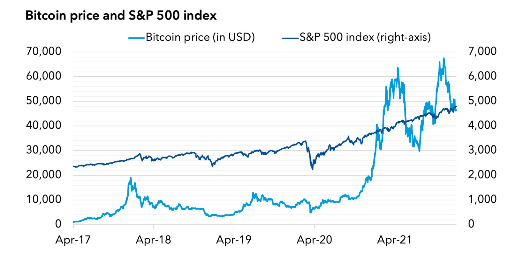

Bitcoin and the S&P 500 Are Moving Together Ever Since the Pandemic

Before the coronavirus pandemic, crypto assets like Bitcoin and Ether showed very little correlation with major stocks and indices. However, they have begun to show an increasing correlation with the S&P 500 index since the pandemic.

This is both a good and a bad thing for existing and potential investors. While cryptocurrencies were thought to diversify portfolios and risk, they are no longer as reliable. This could mean that during times of inflation or economic crises, cryptocurrencies no longer remain independent assets that guarantee profits.

On the other hand, cryptocurrencies are more closely mirroring trusted indices, which means they may be becoming more predictable. This also makes them safer bets when it comes to investments and hedging.

Other correlations are also emerging between crypto equities. It’s also apparent that in emerging market economies, several of which have led the way in asset adoption. For example, correlation between returns on MSCI emerging markets index and Bitcoin was 0.34 in 2020-21. This is a huge increase from preceding years.

Other strong correlations have suggested that Bitcoin has been acting as a very risky asset. Its correlation with other stocks and assets has turned higher than either gold or investment grade bonds. While this may be a concerning development, it shows just how central Bitcoin is to the crypto market. It has become as valid or as trusted in many investors’ eyes as the S&P 500 and gold. This is no small feat, taking into account that the currency is just over 10 years old.

Bitcoin can be seen as the building block for all later cryptocurrencies. While it’s not like gold or silver, or other minerals, it’s definitely a foundational object. It is the very metric on which the cryptocurrency market defines its value.

As such, it’s understandable why the cryptocurrency market hinges on its value when major upheavals take place. It’s ironic that Bitcoin has become incredibly like the very currency it was born to counter. As the dollar represents world trade and banks, Bitcoin now represents world crypto markets. Without it, the entire cryptocurrency system is adrift.

This is why Bitcoin is considered essential and central to the worldwide crypto market. Without it, the entire system would simply fall apart.